Posted on

December 4, 2012

by

Wally Marcinkovic

December 3, 2012

VICTORIA BC- While the number of single-family home sales has held relatively steady over the last three months, Greater Victoria REALTORS® are noting a year-over-year decrease that coincided with tighter mortgage regulations imposed in July of this year. Amortization periods were reduced to 25 years for high-ratio buyers - those with less than 20% down payments.

"The change from a 30- to 25-year amortization can result in an additional $150 to $200 on the monthly mortgage payment, which is impacting many first-time homebuyers and limiting the number entering the market," says Carol Crabb, President of the Victoria Real Estate Board.

Crabb also notes that the median price for a single-family home in Victoria remains relatively flat, increasing 1% over November 2011. "Sales may have slowed, but the median price of single-family homes has not decreased. Condominiums, the primary option for those first-time buyers, have a decreased median price of 10%."

Total MLS® sales for November 2012 were 366 compared to 373 the previous month; 202 single-family homes sold throughout the Victoria Real Estate Board's region, compared to 293 in November 2011. The median price for single family homes was $540,000, up 1% from last November's median of $536,500. The average price for the same period is up $48,373 (8%), but this is influenced by two sales over $2 million and one sale over $5 million. Month-over-month, the six-month average for single-family homes is flat.

"We are now moving into the slower winter season. Both Canada Mortgage and Housing (CMHC) and Cameron Muir, Chief Economist of BC Real Estate Association, predict the next few months will mirror October and November, followed by slow growth for the balance of 2013," Crabb says. BC and Greater Victoria continue to experience strong full-time employment growth, an expanding population and low mortgage rates.

"For buyers, there is a good supply of homes on the market, so while they have time to conduct due diligence they shouldn't expect large reductions on all properties. We are still seeing quick sales and the occasional bidding war on homes that are priced well.

"Sellers have a lot of competition, so curb appeal, how the house shows and competitive pricing are key to moving from 'For Sale' to 'Sold'," Crabb says.

Condominium sales remain stable with 98 in November 2012, compared to 92 in October 2012 and 104 in November 2011, although the year-over-year median price has declined 10%. Townhome sales declined 38% in 12 months, while pricing remains flat.

Total Waterfront Single Family Dwellings sold: 6, down 4 from November 2011

Total Non-waterfront Single Family Dwellings sold: 196, down 97 sales from November 2011

Single Family Dwellings sold over $1 million: 17 (2 over $2 million, 1 over $5 million)

*Negative result reflects a collapsed sale of $1,545,000 reported as complete in September 2012.

Total Single Family All Areas includes Shawnigan Lake/Malahat, Gulf Islands and Up Island

Summary Report and Graphs

Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

November 14, 2012

by

Wally Marcinkovic

Posted on

November 1, 2012

by

Wally Marcinkovic

November 1, 2012 VICTORIA BC - While prices held steady through most of the Greater Victoria region's real estate market in October, government lending regulations have had the desired "cooling effect" on year-over-year sales numbers. Total MLS® sales for October 2012 were 373 compared to 483 in October 2011. During the month, 211 single family homes sold throughout the Victoria Real Estate Board's region, compared to 260 in October 2011. The average price for single family homes was $576,720, down 2% from last October's average of $590,539. The median price for the same period is down $24,000 (4.5%). Month-over-month, both sales volume and the six-month average for single family homes are flat. Active listings are 4,876. "Overall sales for Greater Victoria are down 19%," says Carol Crabb, President of the Victoria Real Estate Board. "Federal measures to slow real estate sales nationally are having a local affect. Our REALTORS® tell me that with the reduced amortization rates, many buyers are having trouble getting financing for the type of home that fits their needs, particularly first-time buyers." Crabb also notes that there are fluctuations across the region. Sales and prices are flat in the Core Municipalities, while sales are down on the Saanich Peninsula, with declined sales and prices on the Westshore. "I strongly caution against reading too much into the numbers," she says. "Both activity and prices vary by sub-area. For some the sample size is always small, so a sale of one or two properties can result in a 50% change." There were 92 condominium sales last month, 37% fewer than during October 2011. Six manufactured homes sold compared to 10 during the previous October. Townhome sales declined 37% and the average price dropped from $428,040 to $387,769, a 9% decrease. Total Waterfront Single Family Dwellings sold: 15, up 3 from 2011

Total Non-waterfront Single Family Dwellings sold: 196, down 52 sales from September 2011

Single Family Dwellings sold over $1 million: 11 (1 over $2 million, 1 over $3 million)

Summary Report and Graphs Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

October 26, 2012

by

Wally Marcinkovic

BCREA 2012 Fourth Quarter Housing Forecast Vancouver, BC – October 26, 2012. The British Columbia Real Estate Association (BCREA) released its 2012 Fourth Quarter Housing Forecast today.  BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 9.8 per cent to 69,200 units this year, before increasing 8.3 per cent to 74,920 units in 2013. The fifteen-year average is 79,000 unit sales, while a record 106,300 MLS® residential sales were recorded in 2005. BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 9.8 per cent to 69,200 units this year, before increasing 8.3 per cent to 74,920 units in 2013. The fifteen-year average is 79,000 unit sales, while a record 106,300 MLS® residential sales were recorded in 2005.

"Despite stronger consumer demand in the interior, BC home sales will fall short of last year’s total,” said Cameron Muir, BCREA Chief Economist. “A moderating trend in Vancouver has recently been exacerbated by tighter high-ratio mortgage regulation. The resulting decline in purchasing power has squeezed some potential buyers out of the market. However, strong full-time employment growth, persistently low mortgage interest rates and an expanding population base point to more robust consumer demand in 2013." "While the average MLS® residential price is forecast to decline 7.6 per cent to $518,600 this year, the change is largely the result of luxury home sales returning to more normal levels after an unusually active 2011,” added Muir. In addition, the Lower Mainland’s share of provincial home sales is expected to decline to 57 per cent this year from 62 per cent in 2011.The average MLS® residential price in BC is forecast to edge up 0.7 per cent to $522,000 in 2013.

Posted on

October 15, 2012

by

Wally Marcinkovic

Vancouver, BC – October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year ago.  "Stricter high-ratio mortgage regulation further exacerbated a moderating trend in consumer demand,” said Cameron Muir, BCREA Chief Economist. “Reducing the maximum amortization from 30 to 25 years had the equivalent impact to affordability as a 100 basis point increase in mortgage interest rates." "Stricter high-ratio mortgage regulation further exacerbated a moderating trend in consumer demand,” said Cameron Muir, BCREA Chief Economist. “Reducing the maximum amortization from 30 to 25 years had the equivalent impact to affordability as a 100 basis point increase in mortgage interest rates."

“An expanding population, strong full-time employment growth and persistent low mortgage interest rates are expected to bolster housing demand in the months ahead,” added Muir. Year-to-date, BC residential sales dollar volume declined 18.5 per cent to $28.4 billion, compared to the same period last year. Residential unit sales declined 10.6 per cent to 54,670 units, while the average MLS® residential price was 8.9 per cent lower at $519,289. For the complete news release, including detailed statistics, click here.

Posted on

October 2, 2012

by

Wally Marcinkovic

Total MLS® residential sales for September 2012 were 400 compared to 435 in September 2011. During the month, 216 single family homes sold throughout the Victoria Real Estate Board's region, just 28 fewer than the 244 sold in September 2011. The average price for single family homes sold in Greater Victoria last month was $589,361, down from September 2011's average of $622,393. The median price is down by $16,500 to $517,500 over September 2011. There are 5,025 active listings.

"We are at a bit of a standoff in the Greater Victoria real estate market," says Carol Crabb, President of the Victoria Real Estate Board. "Buyers are waiting for prices to go down, but there are no economic indicators to show that will happen. Sellers are pricing their properties reasonably for the current market, which is reflected by the fact that single family homes are selling for an average 96% of list price.

"The median price of a single family home is only 1.5% lower than last year and that number has held steady for the last five months," Crabb says.

Condominium and manufactured home sales are virtually unchanged over September 2011 (approximately 1% each), while townhomes sales have declined 10%.

Total Waterfront Single Family Dwellings sold: 18, up 7 sales from 2011

Total Non-waterfront Single Family Dwellings sold: 198, down 35 sales from September 2011

Single Family Dwellings sold over $1 million: 14 (0 over $2 million)

Total Single Family All Areas includes Shawnigan Lake/Malahat, Gulf Islands and Up Island

Summary Report and Graphs

Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

September 12, 2012

by

Wally Marcinkovic

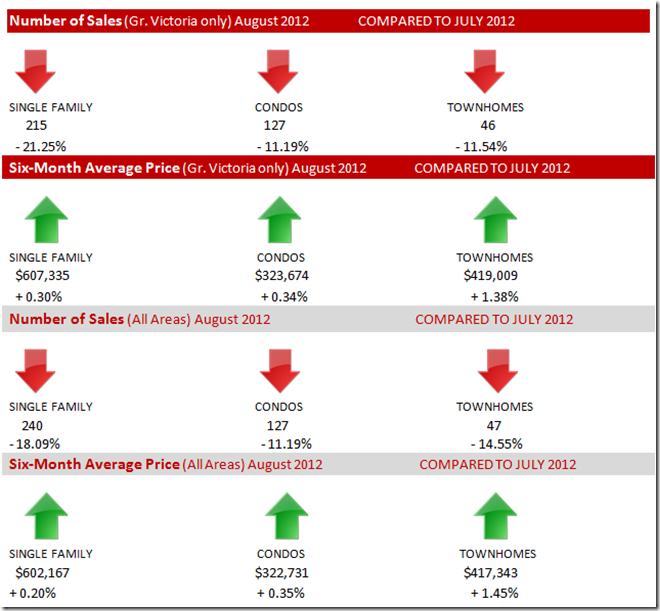

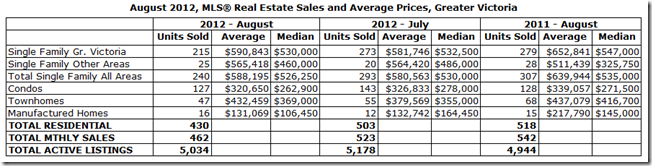

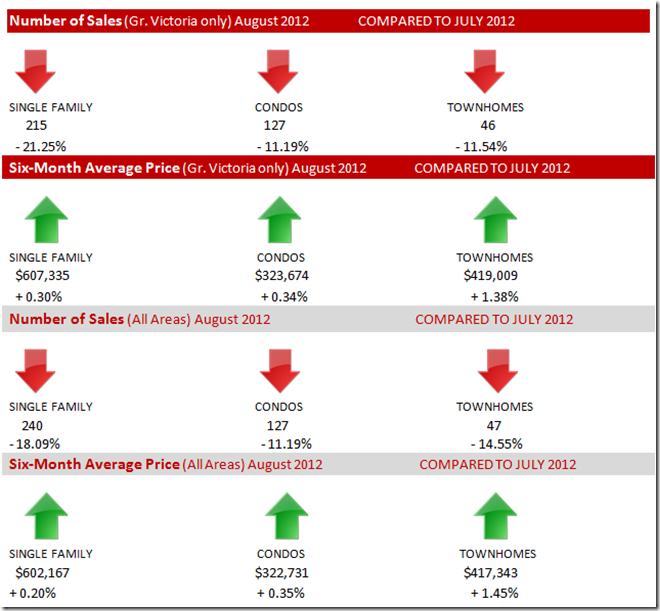

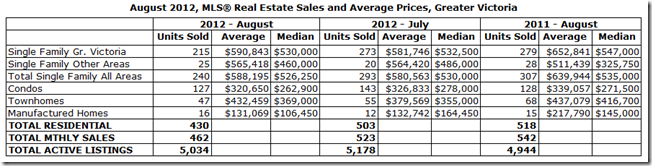

Total MLS® residential sales for August 2012 was 462 compared to 542 for the same period in 2011. During the month, 240 single family homes sold throughout the Victoria Real Estate Board’s region, 67 fewer than the 307 sold in August 2011. The average price for single family homes sold in Greater Victoria last month was $590,843, down from August 2011’s average of $652,841. The median price is down by $17,000 to $530,000. There are 5,034 active listings. "Sales are down 11.5% over August 2011" says Carol Crabb, President of the Victoria Real Estate Board. "When seasonally adjusted, there is little change from July 2012. It’s a flat market which we suspect will continue for the next few months and not trending in either direction." The overall provincial outlook is strong, with employers replacing part-time positions with full-time, and ongoing low interest rates. The British Columbia Real Estate Association predicts the resulting consumer confidence will move the provincial economy from flat to strong in 2013. Other categories are also holding steady. Condominium and manufactured home sales are virtually unchanged over August 2011, while townhomes sales continue to be softer. Total Waterfront Single Family Dwellings sold: 25, down 3 sales from 2011

Total Non-waterfront Single Family Dwellings sold: 215, down 64 sales from August 2011

Single Family Dwellings sold over $1 million: 10 (1 over $2 million)

Summary Report and Graphs Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

August 15, 2012

by

Wally Marcinkovic

August 1, 2012

VICTORIA BC- Real estate activity continues to be steady in Greater Victoria, reflecting favourable conditions attributed to stable pricing, low interest rates and good selection.

Total MLS® sales for July 2012 were 523 compared to 523 for the same period in 2011. During the month, 293 single family homes sold throughout the Victoria Real Estate Board’s region, on par with the 283 sold in July 2011. The average price for single family homes sold in Greater Victoria last month was $580,563, up slightly over July 2011’s average was $574,717. Of note, the median price varies by only $100 year over year. There are 5,178 active listings.

"The market is holding steady, reflecting that good properties that are priced well are selling," says Carol Crabb, President of the Victoria Real Estate Board. "Combined with lots of selection and low interest rates, buyers have good opportunities to buy real estate in the Greater Victoria market. The downward adjustment in volume follows our historical cycle as we transition from a spring to summer market."

Other categories are also holding steady. One variation is that condominium average and median prices are slightly higher, likely resulting from new product on the market.

Total Waterfront Single Family Dwellings sold: 14, down 5 sales over July 2011

Total Non-waterfront Single Family Dwellings sold: 279, up 15 sales over July 2011

Single Family Dwellings sold over $1 million: 14 (1 over $2 million)

Total Single Family All Areas includes Shawnigan Lake/Malahat, Gulf Islands and Up Island

Summary Report and Graphs

Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

July 10, 2012

by

Wally Marcinkovic

It’s been a typical spring market in Greater Victoria real estate with good volume but average prices lower than a year ago. Last month 370 single family homes sold throughout the Victoria Real Estate Board’s region, whereas 348 sold in June 2011. The average price for single family homes sold in Greater Victoria last month was $580,557, a decrease from June 2011’s average of $618,429. Total MLS® sales for June 2012 was 637, with 602 of those residential, compared to 618 and 596 respectively for the same period in 2011, and 659 and 636 last month. There are 5,189 active listings. "For our market, an average month is 500 sales," says Carol Crabb, President of the Victoria Real Estate Board. "Volume during the last three months has been well ahead of that number." Residential sales increased in the Second Quarter of 2012 over the same period in 2011. House sales in Greater Victoria totalled 993 over 924 for Q2 in 2011; 496 condos over 453 in 2011; 189 townhouses over 174; and 44 manufactured homes over 37. Crabb notes, "For the quarter, average price are lower than last year: $608,072 versus the second quarter of 2011 at $624,773. Total waterfront Single Family Dwellings sold: 16, down 8 sales over June 2011

Total non-waterfront Single Family Dwellings sold: 354, up 30 sales over June 2011

Single Family Dwellings sold over $1 million: 21 (3 over $2 million)

Summary Report and Graphs Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

June 25, 2012

by

Wally Marcinkovic

Effective July 9, 2012, the Federal Ministers announcement of Canada’s mortgage insurance lending rules. Key changes: - Reducing the maximum amortization period for high ratio insured mortgages to 25 years from 30 years

- Lowering the maximum amount Canadians can borrow when refinancing using insured mortgages to 80 per cent from 85 per cent of the value of their homes

- Reducing total debt service (TDS) ratio for high ratio insured mortgages to 44 per cent (previously 45%)

- Limiting the availability of government-backed insured mortgages to homes with a purchase price of less than $1 million

All new high ratio approvals with 30 year amortization approved between June 24 and July 9 2012 with the exception of Capped Projects must fund by December 31, 2012. An application must have been approved by CMHC or Genworth prior to July 9, 2012 so the application must be a live deal with an offer in place. Pre approvals done prior to July 9, 2012 and do not have an offer in place must be looked at again by the lender using the 25 year AM. These key changes apply to high ratio financing only. If you have 20% down payment or greater, then you can still qualify for a 30 year amortization. Click here for the Department of Finance Canada Press Release

Posted on

June 19, 2012

by

Wally Marcinkovic

VICTORIA, BC-Consumers are showing confidence in the Greater Victoria real estate market, evidenced by a spike of 71 residential sales in May 2012 over the previous month. "During the last two or three months, we’ve seen many potential buyers out looking," says Carol Crabb, President of the Victoria Real Estate Board. "During May, they made their decisions. This shows there is good selection on the market, as well as good value."

The average price for single family homes sold in Greater Victoria last month was $622,387, a jump over April’s average of $609,376. Excluding previous months’ sales of over $4 million, the median has returned to $534,250.

"Last month we told you that homebuyers were researching their purchases by working with home inspectors, mortgage professionals and REALTORS®," Crabb says. "Now they are moving forward, which is often reflected in a spring market, even though it’s not feeling very spring-like."

Total MLS® sales for May 2012 were 659, with 636 of those residential, compared to 572 and 544 respectively for the same period in 2011, and 586 and 565 last month. We ended May 2012 with 5,015 active listings.

Total waterfront Single Family Dwellings sold: 15, down 3 sales over May 2011

Total non-waterfront Single Family Dwellings sold: 373, up 38 sales over May 2011

Single Family Dwellings sold over $1 million: 24 (3 over $2 million)

Summary Report and Graphs

Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

June 19, 2012

by

Wally Marcinkovic

Posted on

May 5, 2012

by

Wally Marcinkovic

VICTORIA, BC–Pricing and sales numbers for most categories are essentially the same as in March 2012, spelling out a balanced real estate market for Greater Victoria. “That’s good news for both buyers and sellers,” says Carol Crabb, President of the Victoria Real Estate Board. “The one category with increased sales is condominiums with 19% increase. New developments came on‐stream in View Royal and Langford, resulting in a higher sales volume.”

The average price for single family homes sold in Greater Victoria last month was $609,376, down from $640,553 in March which was slightly elevated by two sales over $4 million. The median price, however, rose to $560,000.

“Homebuyers have time to research their purchases without pressure by working with home inspectors, mortgage professionals and REALTORS®,” Crabb says.

Total MLS® sales for April 2012 were 586, with 565 of those residential, compared to 574 and 540 respectively for the same period in 2011. Overall, current sales are on trend with the average 10‐15 year cycle. Active listings were 4,638 for

April 2012.

Cameron Muir, Chief Economist of the British Columbia Real Estate Association, expects modest growth in the economy,

combined with a strong Canadian dollar will keep the Bank of Canada from raising its trend‐setting interest rate until

2013. Total waterfront Single Family Dwellings sold: 13, down 1 sale over April 2011

Total non‐waterfront Single Family Dwellings sold: 316, down 9 sales over April 2011

Single Family Dwellings sold over $1 million: 18 (3 over $2 million)

Posted on

April 19, 2012

by

Wally Marcinkovic

VICTORIA, BC - Single family homes sales have risen 17% since last month, while the six-month average price is up 1% to $599,551. The average price of a Greater Victoria single family home in March 2012 is $640,553 up from $579,985, but is affected by the sale of two homes over $4 million. Compared to March 2011, active listings in this category are up 5% to 1,858, while sales are down 7%. Sales of condos and townhomes are flat, compared to February 2012, while down significantly from 12 months ago (17% and 15% respectively). Condo prices are unchanged, while townhomes are 1% lower than March 2011. "With softer prices, buyers have been looking at houses," says Carol Crabb, President of the Victoria Real Estate Board. "That is now being reflected by the six-month average price increase. We predicted a flat market in January, and so far that is what we are experiencing." She also believes sales activity was affected by poor weather and many families travelling over the two-week spring break. "REALTORS® tell me many clients took the time for family vacations," Crabb adds. With a total of 4,274 active listings, properties on the market have edged up from last month (3,977 active listings at February 29, 2011). Increased supply levels reflect typical spring activity as seen year over year. Total waterfront Single Family Dwellings sold: 14, equal to March 2011

Total non-waterfront Single Family Dwellings sold: 311, down 26 sales over March 2011

Single Family Dwellings sold over $1 million: 26 (4 over $2 million)

Summary Report and Graphs Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

April 2, 2012

by

Wally Marcinkovic

Thinking about buying your first home? Wish you had saved up a good down payment? Maybe you have, but didn't know it. Designed to help first-time buyers get into home ownership, the federal Home Buyers' Program lets you access tax-free monies for use towards the purchase or even construction of your first home.

As a first-time homebuyer, you are allowed to withdraw money tax-free from your RRSP, provided you adhere to the repayment plan. You can withdraw up to $25,000 from your plan. If your spouse qualifies as a first-time homebuyer, then he or she will also be able to withdraw $25,000. Between the two of you, you could possibly have a hefty down payment sum of $50,000. That's enough to make a substantial difference in the affordability of home ownership!

There are certain conditions, for example, you must enter into a written agreement to buy or build before you can withdraw money. And, you must meet the repayment terms. Repayment to your RRSP begins the second year following the year of withdrawal. You have up to fifteen years to repay, and each annual repayment must be at least one-fifteenth of the total withdrawal, otherwise you have to include each repayment amount as income for that year.

A detailed booklet is available on the Canada Revenue Agency website. Look for T1036, which is the form required for requesting a withdrawal.

Posted on

March 10, 2012

by

Wally Marcinkovic

The Victoria Real Estate Board has been made aware of increased confusion over the interpretation of the new BC First-Time New Home Buyers’ Bonus. Board Staff are in regular contact with the Ministry of Finance to ensure have current updates. To clarify: (1) The bonus of a maximum $10,000 is not linked to the buyer’s taxable income unless the individual/couple’s net income from line 236 of their tax return is over $150,000 annually. At that stage the bonus gradually reduces until the annual income reaches $200,000. (2) The bonus will be issued as a cheque by the BC Ministry of Finance. (3) The purchaser will have to apply for the bonus on a form to be available in a few weeks from the provincial government. The application will be processed, and then a cheque will be issued. (4) The amount of the bonus is to be calculated as follows: “The bonus is equal to 5% of the purchase price of the home (or in the case of owner-built homes, 5% of the land and construction costs subject to HST) to a maximum $10,000.” (Source: BC Ministry of Finance, The BC First-Time New Home Buyers’ Bonus fact sheet) For further information, see the BC Ministry of Finance website for their Fact Sheet and “Q&A” documents.

Posted on

March 6, 2012

by

Wally Marcinkovic

VICTORIA, BC-The story continues from last month when the Victoria Real Estate Board reported a relatively stable market when compared to the same time in 2011, but REALTORS® report they are optimistic that new provincial HST transition rules and a New Home First-time Buyers Bonus will stimulate sales of new properties.

February’s sale volume was virtually identical to that of February 2011, but the average price softened by 5% for single family homes over February 2011. The average sales price for a single family home in Greater Victoria was $579,985, with a six-month average of $594,027, showing a corresponding decrease of 4.7% over February 2011.

"REALTORS® are reporting increased showings, especially since the Provincial budget announcements," says Carol Crabb, President of the Victoria Real Estate Board. "Our Members tell me the HST transition rules, increased HST rebates and New Home First-time Buyers Bonus are stimulating traffic for both new houses and condos.

"I think the BC budget also instilled consumer confidence. Potential buyers can see that our economy is stable and mortgage rates are incredibly low", Crabb says. "Not only are prices remaining stable, there are enough listings to allow buyers to perform their due diligence without making rash decisions. We encourage buyers to work with REALTORS® to ensure they are educated about current market conditions and recently announced government incentives."

With 3,977 active listings at the end of February, Crabb notes increased supply levels and sales are expected in keeping with the normal historical trend of spring activity.

Total non-waterfront Single Family Dwellings sold: 258, up 4 sales over February 2011

Total waterfront Single Family Dwellings sold: 7, down 3 sales over February 2011

Single Family Dwellings sold over $1 million: 14 (1 over $2 million)

Summary Report and Graphs links:

Monthly Sales Summary

Average Selling Price Graphs

Active Listings, New Listings and Sales Graphs

Posted on

February 27, 2012

by

Wally Marcinkovic

Yes, I love it! I recall my early days lugging around my Motorola Brick. Since then I have always had the latest and greatest mobile phone available. I was an iPhone user and switched when the Samsung Galaxy S Android device came out. That was a great phone, but as of February 14, 2012, I had my sight set on the release of the Samsung Galaxy Note. Yes, it’s big, but after using it now for about 2 weeks, I can honestly say that the 3.5” or 4” display phones are just too small. I can’t go backwards now. My analogy would be like going from a 42” TV to a 55” TV.

This phone does it all. If you always wanted a larger display and didn’t want a tablet, then this 5.3” HD Super AMOLED screen might be for you. For more information on this product I would recommend going to your telephone provider or you can ask me about mine. Availability is on Bell, Telus and Rogers.

Note: It fits in my pocket!

Posted on

February 25, 2012

by

Wally Marcinkovic

Help for New Home Purchasers

We are analyzing the implications of both the HST Transition and BC First-Time New Home Buyers announcements, and there are still many unresolved details. Here is what we know so far:

Effective April 1, 2012, the government will substantially increase the BC Harmonized Sales Tax rebate threshold for new homes purchased as primary residences to $850,000 (from $525,000), and create a grant of up to $42,500 for newly-constructed secondary homes (purchased outside the GVRD and CRD) where no grant has existed before.

The temporary BC First-Time New Home Buyers’ bonus announced in the budget on February 21 will also provide additional support for buyers who need it the most. This applies to both newly constructed residences and those that have been 90% renovated.

Overall, the benefit to buyers of new homes and people who work in the real estate sector is obvious. Perhaps less apparent is the fact that real estate sales generate significant additional spending and taxes, driving activity throughout the provincial economy.

Now that the rules for transition back to a Provincial Sales Tax/Goods and Services Tax system have been published, and the transition dates set, buyers of new homes, REALTORS®, builders and developers will have more confidence and the freedom to transact business.

Questions and Answers

Question #1 – Is the “bonus/grant” for first-time buyers to be paid by tax credit or cheque?

Answer – The purchaser will have to fill out an application form which will be available on the Ministry of Finance website later this year. Application forms will need to be completed and sent to the BC Ministry of Finance for processing. The bonus will be issued as a separate chequefrom the BC Ministry of Finance. The BC Ministry of Finance will be issuing the refund.

Here you will find information on the bonus as well as some other frequently asked questions.

Question #2 –How can buyers confirm the amount of money they will be eligible to receive, or is it just a guessing game until the application is approved?

Answer –The attached Fact Sheet from the BC Ministry of Finance indicates that the “bonus” for first-time buyers is “equal to 5% of the purchase price of the home (or in the case of owner-built homes, 5% of the land and construction costs subject to HST) to a maximum of $10,000.”

www.bcbudget.gov.bc.ca/2012/homebuyers/2012_First_Time_Home_Buyers_Fact_Sheet.pdf

Question #3 – What about HST phase out on real estate commissions?

Answer – The tax structure on real estate commissions will not change until April 1, 2013 when the return to the Provincial Sales Tax (PST) regime is fully implemented, and then only the GST will apply to those goods and services that were exempt from PST prior to July 1, 2010. This was confirmed for BCREA by Hon. Kevin Falcon in early October 2011.

Online Resources

· BC Government Return to PST website: http://www.pstinbc.ca/buying_goods/buying_a_home

· BC Government HST Transition news release: http://www.newsroom.gov.bc.ca/2012/02/transition-measures-support-new-home-buyers-builders.html

BC First-Time New Home Buyers’ Bonus fact sheet: www.bcbudget.gov.bc.ca/2012/homebuyers/2012_First_Time_Home_Buyers_Fact_Sheet.pdf

|

BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 9.8 per cent to 69,200 units this year, before increasing 8.3 per cent to 74,920 units in 2013. The fifteen-year average is 79,000 unit sales, while a record 106,300 MLS® residential sales were recorded in 2005.

BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 9.8 per cent to 69,200 units this year, before increasing 8.3 per cent to 74,920 units in 2013. The fifteen-year average is 79,000 unit sales, while a record 106,300 MLS® residential sales were recorded in 2005.  "Stricter high-ratio mortgage regulation further exacerbated a moderating trend in consumer demand,” said Cameron Muir, BCREA Chief Economist. “Reducing the maximum amortization from 30 to 25 years had the equivalent impact to affordability as a 100 basis point increase in mortgage interest rates."

"Stricter high-ratio mortgage regulation further exacerbated a moderating trend in consumer demand,” said Cameron Muir, BCREA Chief Economist. “Reducing the maximum amortization from 30 to 25 years had the equivalent impact to affordability as a 100 basis point increase in mortgage interest rates."